What is ITR for TDS Filing?

Are you confused about ITR filing for TDS? Do you live in Rewa, Madhya Pradesh, and want expert assistance in managing your Income Tax Return (ITR) for Tax Deducted at Source (TDS)? This guide from Smart Tax Idea – Your Trusted CA Partner in Rewa explains everything you need to know in simple language with a professional approach.

Introduction

Why TDS Filing Matters

TDS (Tax Deducted at Source) is a tax collection mechanism by the Government of India, where tax is deducted by the payer before making a payment like salary, rent, or interest. If TDS is deducted from your income, it becomes essential to file an ITR (Income Tax Return) to claim a refund (if applicable) or to maintain compliance with the Income Tax Act.

At Smart Tax Idea, we specialize in TDS filing, ITR filing, and complete tax compliance solutions in Rewa with expert guidance from qualified Chartered Accountants.

Income Tax Return (ITR) Guide

Understanding ITR filing and its importance for financial compliance

What is ITR and Why is it Important?

ITR (Income Tax Return) is a document filed with the Income Tax Department of India to report your annual income, deductions, taxes paid (like TDS), and any refund claim.

- ✅ Claim refund of TDS deducted

- ✅ Avoid penalties for non-filing

- ✅ Required for visa applications

- ✅ Mandatory for loans, tenders, and financial transparency

- ✅ Helps in carrying forward losses

- ✅ Legal compliance for salaried, freelancers, and business owners

Purpose of ITR for TDS Filing

When TDS is deducted from your income—be it salary, professional fees, rent, interest, or commission—you must file ITR to:

- Reconcile the tax deducted vs. actual liabilityd

- Claim refunds if excess TDS has been deducted

- Maintain compliance to avoid future scrutiny or notices

- Show proof of income and tax deduction for credit, legal, or financial purposes

Documents Required for ITR Filing (With TDS)

Before you start, gather the following documents:

At Smart Tax Idea, Rewa, we help you collect, verify, and review these documents to ensure error-free ITR filing.

Step-by-Step Process: How to File ITR for TDS

Follow these detailed steps for hassle-free ITR filing

Understand Your TDS and Income Type

Check Form 26AS or AIS on the income tax portal to identify where TDS has been deducted—salary, interest, rent, etc.

Create/Login to Income Tax Portal

- 1 Go to https://www.incometax.gov.in/iec/foportal/

- 2 Click on 'Login'

- 3 Enter your PAN (as user ID), password & captcha

- 4 Use OTP verification (linked with Aadhaar or phone)

Check TDS Details in AIS/26AS

•Download Form 26AS or AIS from the portal

•Cross-verify with your documents

•Ensure all TDS entries are correct and updated

Select the Appropriate ITR Form

•ITR-1 (Sahaj) – Salaried individuals

•ITR-2/3/4 – For business, freelance, or rental income

Don't worry — Smart Tax Idea helps you choose the right ITR form based on your profile.

Enter Income & Deduction Details

•Report all income (salary, FD interest, house property, etc.)

•Claim eligible deductions under 80C, 80D, 80G, etc.

•Auto-import or manually fill TDS details

Calculate Tax Liability & Refund

The system will auto-calculate your final tax payable or refund based on your income, TDS, and deductions.

Submit & Verify the Return

•Click "Submit"

•Choose e-verification method – Aadhaar OTP / Net Banking / EVC

•After verification, download ITR-V (acknowledgment)

Why Choose Smart Tax Idea for ITR & TDS Filing in Rewa?

As a trusted CA service provider in Rewa, we bring:

- ✅ Expertise: Qualified CAs handling your compliance

- ✅ Accuracy: 100% error-free ITR filing

- ✅ Local Advantage: Office in Rewa for in-person support

- ✅ TDS Refund Support: We follow up with the IT department for faster refunds

- ✅ Affordable Plans for salaried, business owners, and freelancers

Final Words: Don't Delay Your TDS Filing – Let Experts Handle It

Filing an ITR for TDS is not just a formality—it's a financial safeguard and a legal necessity. Mistakes in filing can lead to penalties or refund delays.

If you're looking for expert TDS return filing in Rewa, trust Smart Tax Idea, the preferred CA firm in Rewa, Madhya Pradesh. We'll guide you from document collection to return filing and refund tracking.

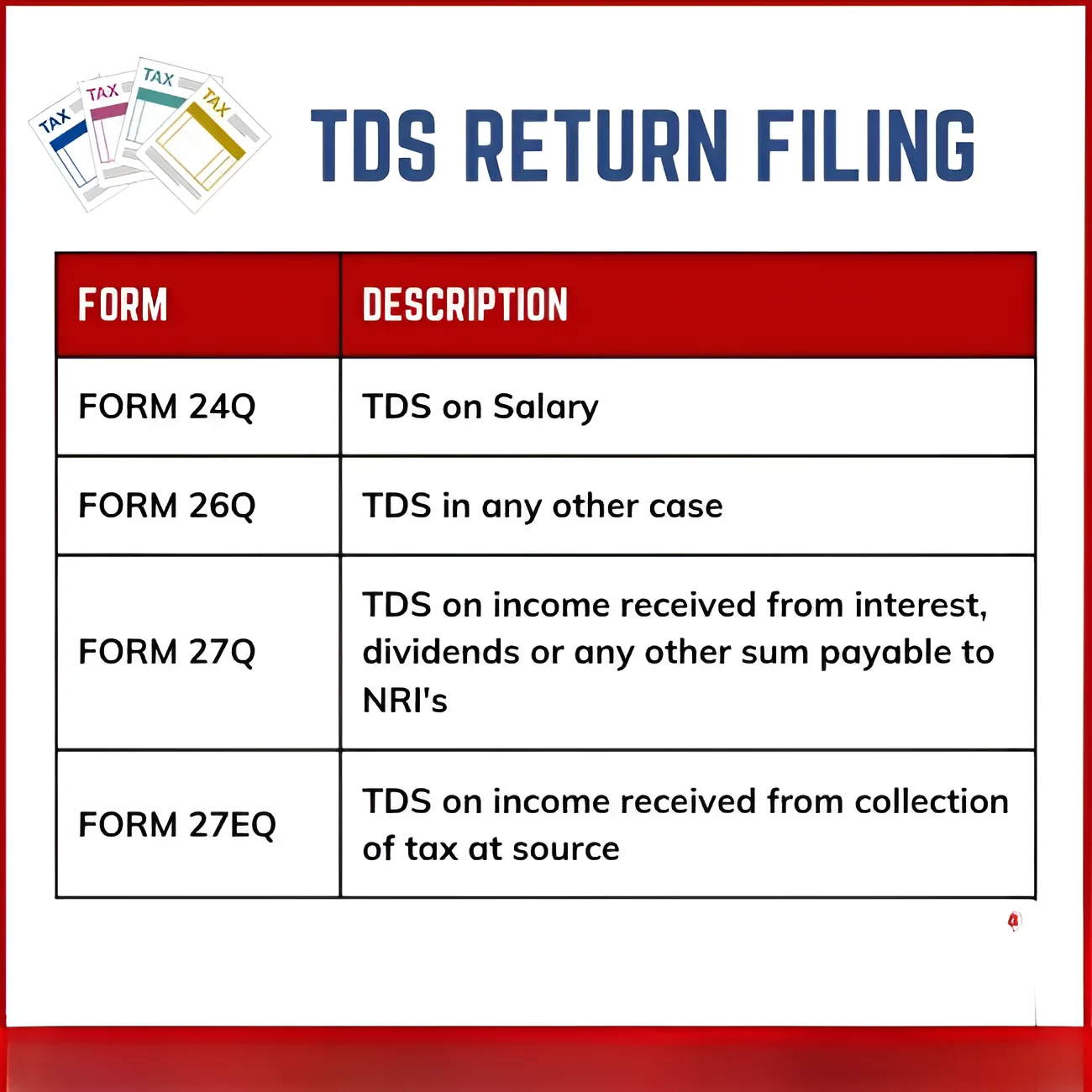

TDS TYPE

Here are some of the income sources that qualify for TDS:

.

.

Frequently Asked Questions

To file a TDS Return online, follow these steps:

- Collect the required data: PAN of deductees, challan details, amount paid, etc.

- Use the RPU (Return Preparation Utility) from NSDL or a TDS software.

- Validate the file using FVU (File Validation Utility).

- Login to the TIN-NSDL portal (or TRACES) and upload the validated file.

- Acknowledge with Form 27A and Digital Signature Certificate (DSC) if applicable

Here are the TDS filing due dates for all quarters of the financial year:

| Quarter | Period Covered | Due Date for Filing |

|---|---|---|

| Q1 | April - June | 31st July |

| Q2 | July - September | 31st October |

| Q3 | October - December | 31st January |

| Q4 | January - March | 31st May (Next FY) |

Tip: Filing late can attract penalties under Section 234E and 271H. Stay compliant with timely reminders from Smart Tax Idea, Rewa’s trusted TDS filing experts.

To file TDS online:

- Visit: https://www.tin-nsdl.com

- Login using your TAN and credentials

- Go to e-TDS/e-TCS return filing

- Upload the validated FVU file

- Use Digital Signature Certificate (DSC) if required

- Submit and download the acknowledgement receipt

Avoid these common errors during TDS filing:

- Incorrect PAN or TAN entries

- Wrong challan number or BSR code

- Non-matching TDS amounts in Form 26Q/24Q and actual deduction

- Missing due dates leading to penalties

- Mismatched return types or quarter selection

- Not downloading and checking Form 26AS

There are multiple types of TDS based on nature of payment:

| Nature of Paymen | Section | Applicable TDS Rate |

|---|---|---|

| Salary | 192 | Slab-based |

| Interest (Bank/FD) | 194A | 10% |

| Rent | 194I | 2%-10% |

| Contractor Payment | 194C | 1%-2% |

| Commission or Brokerage | 194H | 5% |

| Professional Fees | 194J | 10% |

| Purchase of Property | 194IA | 1% |

Different rules apply depending on your entity type, PAN availability, and nature of transaction.